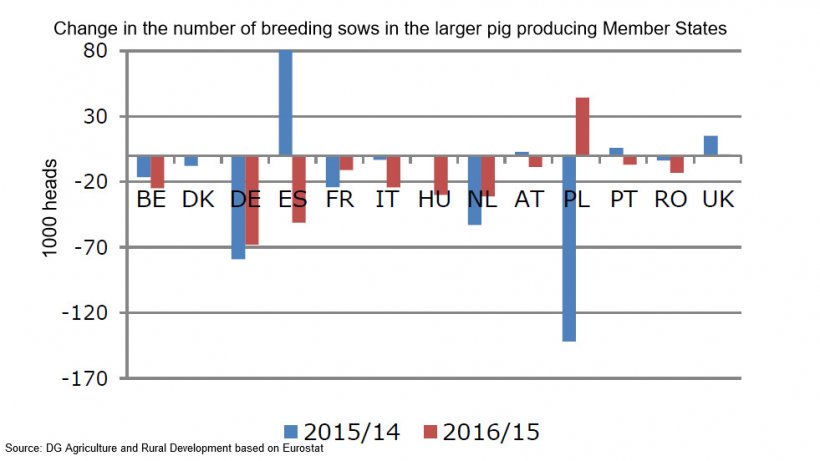

In 2017, EU pig production is expected to slow down further because of the decrease in the sow herd and the lack of availability of piglets. According to the December 2016 livestock survey, the number of pigs for fattening (all categories) in the EU has decreased by 360 000 heads and the number of piglets by 374 000 heads. These overall figures hide wide discrepancies between Member States. The EU pigmeat production in 2017 is expected to decrease slightly to around 23.4 million t (-0.3%) and stabilise in 2018 driven by sustained exports and rewarding margins.

The current level of EU exports to China should be considered as a short-term opportunity rather than a constant over the medium-term. Other important exporters to China are the US and Canada, who clarified with the Chinese authorities the ractopamine-free status of their pigmeat exports. In 2017, EU pigmeat exports are expected to decline by 9%, but stay above 2.5 million t, mainly due to lower exports to China. The Russian sanitary import ban introduced in March 2014 is expected to remain in place during the outlook period (until 2018).

Despite a brief surge, feed prices, especially soya, came down again, reducing feed costs and improving the profitability of pigmeat production. EU consumption of pigmeat reached 32.4 kg per capita in 2015 (retail weight), almost 1 kg above 2014. In 2016, the opportunity to export to China and a slowdown in EU production meant that less pigmeat was available on the EU market. Per capita consumption decreased significantly by 2.4% (31.5 kg per capita) and is expected to stabilise in 2017 and 2018.

Thursday March 9, 2017/ DG Agriculture/ European Union.

https://ec.europa.eu/agriculture