Coarse grains

:

Robust demand and tight supplies

At a record 1 516 million tonnes, world coarse grains production in 2021 is forecast to increase by 36 million tonnes (2.5 percent) from 2020, almost exclusively due to higher maize production. A large expansion in maize production in the United States accounts for the bulk of the expected global increase, in addition to greater outputs anticipated in China, the European Union and Ukraine. World production of sorghum is also foreseen to rise in 2021/22, while barley production is set to decline, largely on expected reduced output in Australia.

World utilization of coarse grains is forecast to increase in 2021/22 by 1.4 percent, reaching an all-time high of 1 526 million tonnes. The main driver of this growth is a rise in industrial use, stemming from expected greater utilization of maize for the production of ethanol. Increased feed use of both maize and sorghum, especially in China, is also seen lifting coarse grains utilization in 2021/22.

With the 2021/22 utilization forecast exceeding the global production forecast, coarse grains stocks are expected to contract by the close of seasons in 2022, falling by 1.7 percent below their opening levels. This decline is largely attributed to a likely further drawdown of maize inventories in China. In combination with the forecast rise in utilization, the expected fall in global coarse grain inventories would lower the world stocks-to-use ratio to its lowest level since 2012/13.

Larger shipments of maize and sorghum are seen balancing an expected reduction in barley trade, keeping global trade in coarse grains in 2021/22 near the 2020/21 record level. Continued strong import demand from China is anticipated to remain an important driver of the expected growth in trade for maize and sorghum, in addition to expectations of increased maize purchases by the European Union, Mexico, and Turkey. On the export side, larger shipments of maize are forecast for Argentina and Ukraine and increased sorghum exports are expected from the United States of America

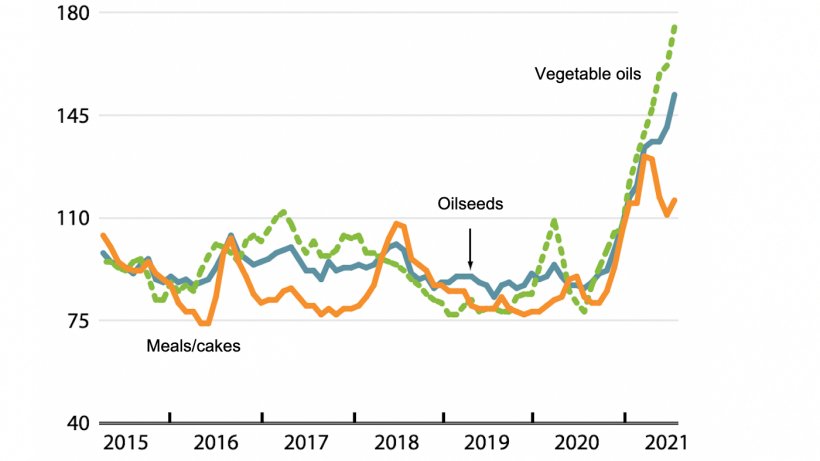

Oilseeds: Tight market outlook

In 2020/21, global oilcrop production is expected to recover from the previous season’s reduced level, with an area-driven rebound in soybean and rapeseed production more than offsetting a weather-induced contraction in world sunflower seed output. While global supplies of meals/cakes are set to recover, global consumption is forecast to continue expanding, led by increasing consumption in China. With global meal uptake expected to surpass world supplies, global carry-out stocks of meals/cakes are anticipated to contract for a second consecutive season, possibly dropping to a seven-year low and entailing a further decline in stocks-to-use ratios.

As for oils/fats, global output is expected to recover from the previous season’s exceptional contraction, largely underpinned by gains in palm and soyoil production. Meanwhile, global utilization of vegetable oils is seen expanding modestly, with below-average growth in both food and non-food uses, linked to the protracted COVID-19 crisis and record-high vegetable oil prices. With total oils/ fats production poised to fall short of utilization, global inventories of oils/fats are forecast to drop to an 11-year low, while stocks-to-use ratios would also fall markedly.

With regard to the forthcoming 2021/22 season, tentative forecasts suggest a slight improvement in the global supply-demand conditions. Initial crop forecasts point to a likely significant expansion in global output of oilmeals and vegetable oils, while growth in total utilization of oilcrop products is anticipated to accelerate somewhat. Accordingly, moderate stock replenishments could take place for both meals and oils, although stocks-to-use ratios would still linger below the levels observed in recent years, pointing to persistent supply-demand tightness. However, this outlook remains subject to major uncertainties, notably with regard to weather conditions in key growing regions, the evolution of the COVID-19 pandemic and vaccination campaigns, and national policy measures that could affect global trade flows of oilseeds and derived products, as well as the implementation of biodiesel admixture mandates.

June 10, 2021/ FAO.

http://www.fao.org/