For the second year in a row, world pig meat output is forecast to record a sharp contraction, down 8% from last year falling to 101 million tonnes in 2020.

In China, pig meat output is expected to fall 20% to 35 million tonnes, largely due to the spread of ASF. This decline follows the 21% retreat already recorded in 2019. ASF outbreaks are also behind projected output falls in Viet Nam and the Philippines, whereas a smaller pig herd is forecast to bring output down in Ukraine. In the USA, the negative production outlook is mainly linked to COVID-19 market disruptions.

By contrast, in the EU and the UK, strong import demand, especially from China, is supporting an expansion of the sector. In Brazil, stable feed costs and large pig herd numbers are sustaining production, while in the Russian Federation output growth is underpinned by large-scale investments in new breeding and processing facilities.

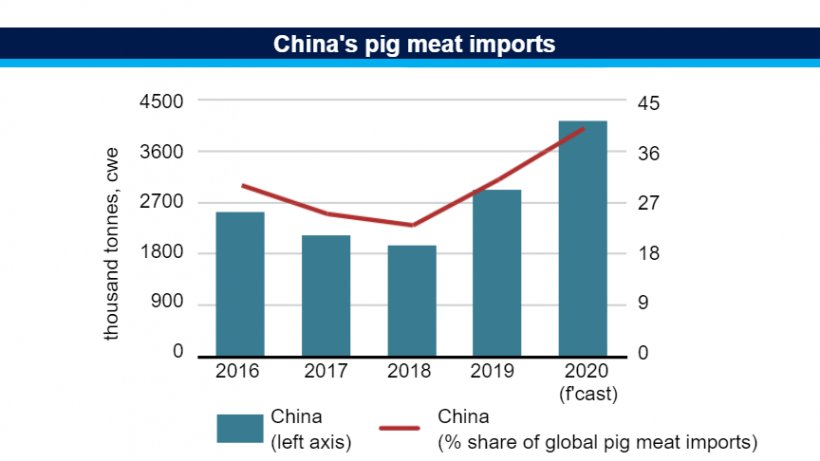

In China, pig meat imports are expected to rise by 1.2 million tonnes or 42 percent in 2020, to reach 4.1 million tonnes, equivalent to 40 percent of the global volume of trade in pig meat. Likewise, imports by the Philippines and Viet Nam are projected to rise mainly to compensate for the production shortfalls caused by the ASF disease. Limited domestic supplies are also expected to increase imports by Ukraine. By contrast, the Republic of Korea is forecast to reduce its pig meat purchases due to a contraction in domestic food service sales.

World pig meat exports are forecast at 10.6 million tonnes in 2020, up 11.2 percent from last year, predominantly driven by larger anticipated imports by China, along with expected moderate increases in purchases by Viet Nam, the Philippines, Chile and Ukraine.

Despite the anticipated small production contraction, the USA will likely see its exports surge by 13 percent, with the bulk directed to China, Mexico, Japan, Canada, the Republic of Korea and Australia. In the EU and the UK, increased availabilities have resulted from falling domestic pig meat consumption and rising production, which may lead to larger exports, especially to China, in the wake of newly signed agreements between China and key EU suppliers. Brazil’s pig meat exports could also rise, due to increased deliveries to China, although sales to other trading partners may fall.

August 6, 2020/ FAO/ United Nations.

http://www.fao.org/