Corn

Corn

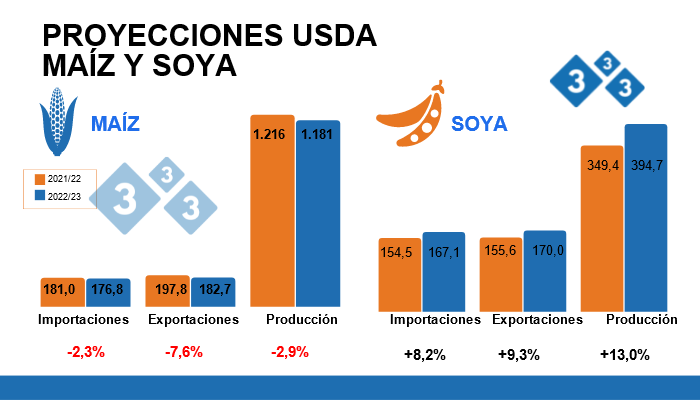

According to the first estimates presented on May 12 by the USDA for the new 2022/23 corn crop, world production will reach 1,180.7 million tons (Mt), 2.9% lower compared to the 2021/22 crop (1,215.6 Mt). This would be explained by the decline in production in some of the main producing countries, such as the United States and Ukraine.

United States production is expected to reach 367.3 Mt, down 4.3% compared to the previous crop (383.9 Mt). Likewise, a reduction of 0.6% is forecast for China, with a production volume expected to reach 271 Mt. Brazil's production will reach 126 Mt, thus increasing by 8.6% compared to the 2021/22 season (116 Mt). Finally, production in the European Union and Argentina will reach volumes of 68.3 and 55 Mt, which represent variations of -3.2% and 3.8% compared to the previous season. It is worth mentioning that Ukraine's production volume is projected to decrease by 53.7%, from 42.1 Mt to 19.5 Mt in this new crop, while Russia is expected to see a volume of 15.5 Mt and a growth of 1.8%.

As for international trade, world corn exports are estimated to decrease by 7.6%, from 197.8 Mt in the 2021/22 season to 182.7 Mt for the new crop. This would be largely due to the significant decline in exports from Ukraine (-60.9%) and the United States (-4%), which would be in line with the drop in their production. However, South American exportable supply is expected to increase by 5.6% in Brazil with 47 Mt and by 5.1% in Argentina with 41 Mt. On the other hand, China will demand 18 Mt in corn imports, which represents a decrease of 21.7% despite the reduction of its domestic production, while Vietnam would increase its imports by 25% reaching 11.5 Mt.

Soybeans

World soybean production for this new crop will increase by 13% compared to the 2021/22 season, from 349.4 to 394.7 Mt, which reaffirms its tendency to concentrate and expand year after year in exporting countries. In fact, the Brazilian crop, which is currently the most significant, would reach 149 Mt, a figure that represents an increase of 19.2% with respect to the previous cycle (125 Mt). On the other hand, the US crop is expected to grow by 4.6%, from 120.7 Mt to 126.3 Mt, while Argentina is expected to grow by 21.4%, thus achieving a production record of 51 Mt.

Export activity will continue to be led by Brazil with 88.5 Mt, up 6.9% from the previous season, while the United States will reach an export volume of 59.9 Mt, up 2.8% from the previous crop. China will continue to be the main importer of the oilseed at the global level with 99 Mt and a 7.6% growth compared to the 2021/22 crop.

Economic Analysis Department of 333 Latin America with data from USDA. United States.

https://apps.fas.usda.gov/