The piglet crop in 2022 is forecast lower than 2021 given PEDv and processing issues. Concerns about global supplies and access to feed and fertilizer, coupled with the ongoing impacts from the 2021 drought, could see precarious feed conditions persist for some time.

Exports of live hogs are revised upwards as a result of ongoing processing disruptions in Eastern Canada. Olymel is proceeding with cessation of the slaughter line at their Princeville facility which will displace an estimated 702,000 head per year. Additionally, Olymel will reportedly be ceasing the second slaughter shift at their Yamachiche plant in April 2022, as the company focuses on increasing their value added output by re-purposing workers to fabrication shifts. Ultimately, this leads to Olymel purchasing 1.2 million fewer hogs per year. In the interim, this will impact Ontario and Quebec producers. Early reports suggest that some hogs will end up in Manitoba and others in Ontario and Quebec plants. however, producers will be looking to the United States for exports and depending on the market, reductions in production could ultimately occur.

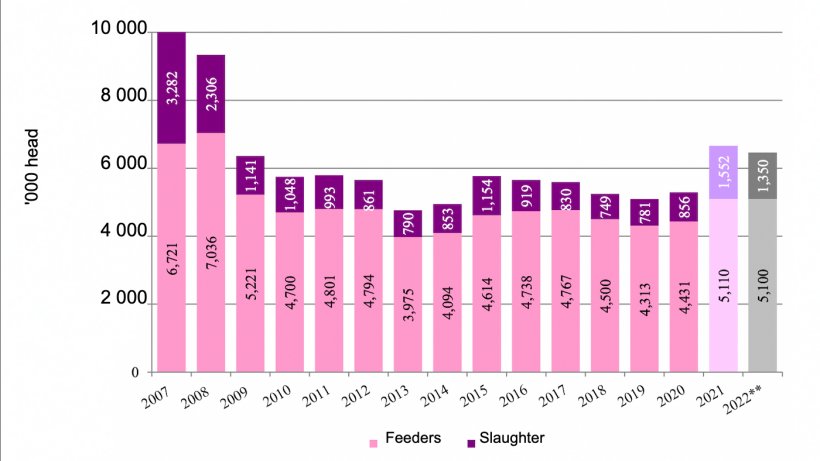

USDA forecasts that 2022 feeder exports to the United States will remain stable on 2021 feeder exports. Manitoba will continue as the main supplier of feeder hogs but additional animals in Eastern Canada will be exported as a result of the Olymel slaughter reduction. Manitoba will keep a larger number of feeders in province as a result of a net gain in finishing spaces but weanling production will still outpace slaughter capacity and longstanding relationships between Canadian producers and U.S. finishers will support continued movement of weanlings for finishing in the United States. Slaughter ready exports are forecast down 13% from 2021 on the expectation that the Quebec backlog of slaughter ready hogs will be cleared by the end of Q1 2022 but that higher slaughter exports will still be supported as Quebec and Ontario hogs are displaced by the slaughter reductions at Olymel.

Carcass weights for 2022 are forecast to decline by 3% as carcass weights were heavier due to issues such as labor shortages, supply chain issues, and a plant strike. However, 1% growth in slaughter is forecast for 2022, as capacity utilization improves at some plants despite the Olymel reduction.

Pork exports are expected to reach 1.485 million metric tons in 2022. Canada has seen significant declines in export volume to China due to COVID-19 restrictions and the recovery of the Chinese herd. As Olymel looks to focus more on value added product, they will be seeking to increase exports of those products in 2022. Canada will continue to look to Asian markets for increased export activity and value.

Pork imports are forecast to decline by 1% in 2022 as domestic demand is stagnant and storage stocks are at historic highs. However, imports continue to be supported by consumer preference for specific cuts. The United States will remain the dominant source market for imports.

April 1, 2022/ USDA/ United States.

https://apps.fas.usda.gov/