Japan's swine herd at the start of 2020 stood at 9.060 million head as producers took longer than expected to recover from classical swine fever (CSF). It was previously thought that swine and sow stocks would continue growth in 2019 as larger producers ramped up operation to offset the production decline in CSF-affected regions. However, CSF has since spread to an additional nine prefectures, increasing the 2019 year-end cull figure to 144,000 hogs (1.6 percent of beginning swine stocks). Piglet production for 2020 is estimated at 16.8 million head.

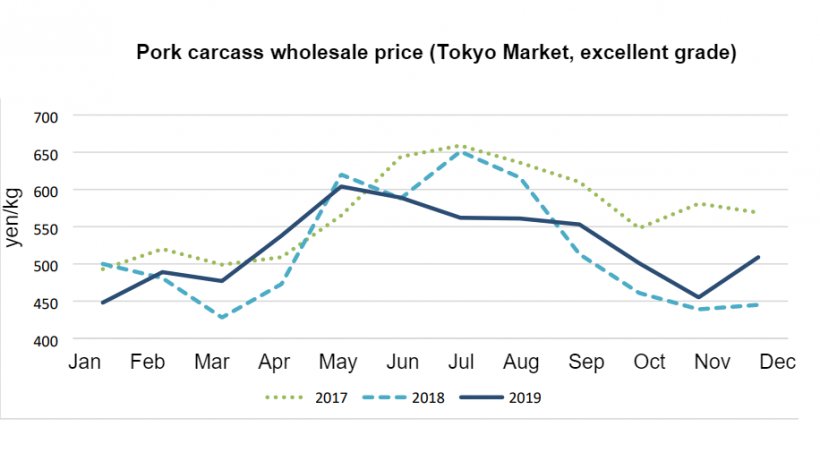

Regions unaffected by CSF such as Hokkaido and Aomori, the third and fourth largest producing prefectures, helped fill the supply gap in 2019 by increasing hog slaughter four percent and three percent, respectively. Carcass prices rebounded in the late 2019, incentivizing unaffected operators to expand the sow population and ramp up operations.

Estimated hog slaughter in 2020 is predicted to be 16.360 million head due to lower piglet production and increased sow retention. Pork production is estimated at 1.280 million metric tons, similar to that in 2019.

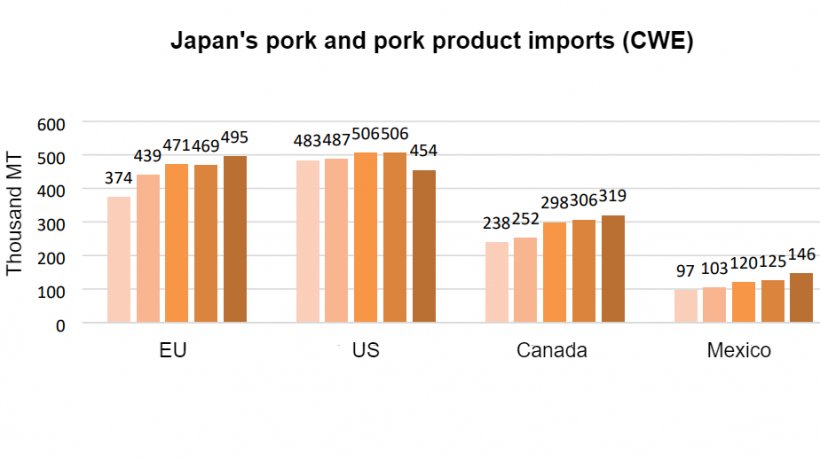

Although projected total pork imports are forecasted lower in 2020, the United States is expected to regain market share as a result of the U.S.-Japan trade agreement. In 2019, major suppliers including the European Union, Canada, and Mexico gained preferential tariff advantages. As a result, Japanese imports from the European Union grew six percent to 495,049 MT (carcass weight equivalent) while imports from Canada grew four percent to 319,420 MT and from Mexico 16 percent to 145,627 MT. Meanwhile, 2019 imports from the United States, the second largest supplier, fell 10 percent to 453,968 MT.

February 28, 2020/ USDA/ United States

https://apps.fas.usda.gov/