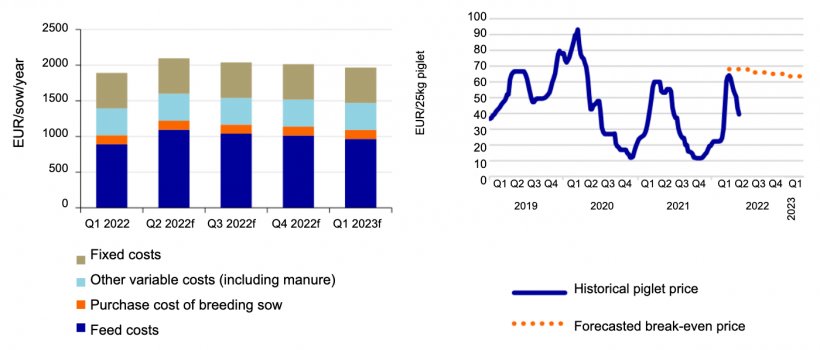

According to Rabobank, piglet prices in the Netherlands would need to reach EUR 68 per piglet in order for sow farmers to break even due to the rising cost of feed and energy. At the beginning of the second quarter, the average piglet price increased to EUR 60 per piglet, however that price level was not maintained. After the peak in week 13, the price gradually dropped to EUR 39/kg piglet in week 20. Piglet prices around the current break-even level were seen in the summer of 2019 and from the end of 2019 through the first half of 2020. However, the demand situation was very different from that of today as China’s pork imports had hit a record high at the time. Rabobank says there is little chance that the piglet price will reach break-even levels in 2022, while supply is expected to contract across Europe.

Right: Forecasted break-even piglet prices. Source: European Commission, Rabobank 2022.

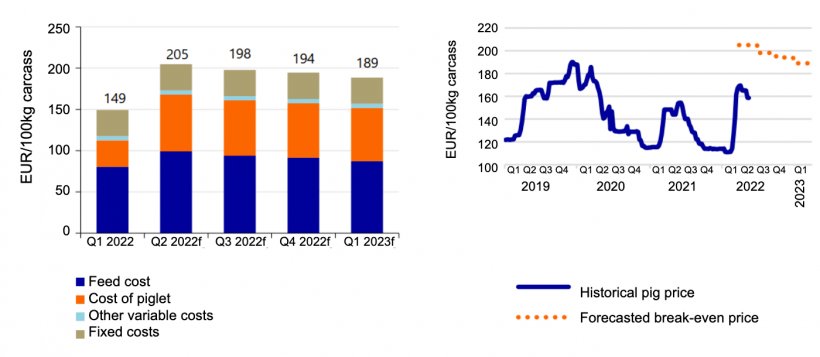

Should the sow farmer break even, the cost price for fattening pigs would be 38% higher in the second quarter of 2022 compared to the first quarter of 2022. To cover all costs for fattening farms, the carcass price would have to be EUR 205 per 100kg carcass. As carcass prices have remained below this level even during the period of high demand in 2019 and 2020, it seems highly unlikely that this break-even level will be reached in 2022. The average pig carcass price in week 20, for example, was only EUR 158 per 100kg carcass in the Netherlands. Therefore, the margins of fatteners are also under pressure, even considering that piglet prices are currently below the break-even level.

June 2022/ Rabobank.

https://research.rabobank.com