International meat prices

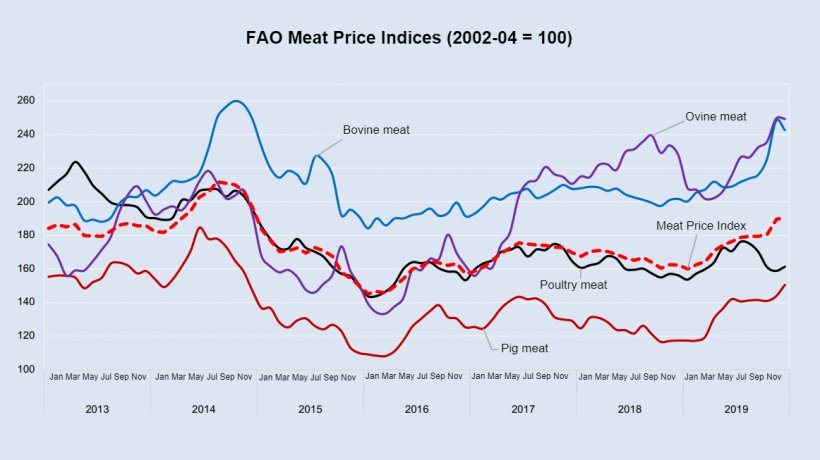

Meat prices measured by the FAO Meat Price Index, averaged 175.7 in 2019, an increase of 9.4 points (5.6 percent) from 2018, rebounding from a 2.3 percent decline registered in 2018. The tightening of markets characterized the global meat sector in 2019, as pig meat production plummeted because of the large loss of pig herd due to the African Swine Fever (ASF) in China and parts of East Asia. Although the output of other meat types, especially poultry, increased, it was inadequate to fill the gap created by the fall in pig output. This, in turn, created a meat deficit in East Asia with a parallel spike in import demand. Many meat producing countries responded by increasing meat output and exports, but combined global exports were still far below the required level to fill the deficit, causing international meat prices to rise.

World meat output

World meat output in 2019 fell by 1.0 percent from 2018 to 338.8 million tonnes (in carcase weight equivalent). The drop was principally caused by a 9.2 percent decline in global pig meat production, as ASF decimated pig herd in East Asia, especially China, the world’s largest pig meat producer. In response, key meat producers in the world expanded output in other meat complexes, especially poultry, benefitting from a shorter production cycle, partially compensating for the pig meat shortfall.

Across countries, China recorded an 8.8 percent decline in overall meat production (equivalent to 7.8 million tonnes), as pig meat output plummeted by 21 percent, but offset by increases in other sectors, mostly poultry. Vietnam saw a 15% drop in pig meat output. However, significant meat output expansions were recorded in the United States of America, Brazil, India, Mexico, the Russian Federation, Canada and Argentina. Sharp increase in import demand was a principle motive behind these expansions in meat output.

World meat exports

Wold meat exports expanded by 6.8 percent to 36 million tonnes in 2019, with the largest growth registered for pig meat, followed by bovine and poultry meats. Induced by the large meat deficit, China imported 37 percent more meat in 2019 (around 2 million tonnes) than in 2018, with increased purchases across all meat categories. By contrast, several countries, especially Angola, Viet Nam, Iraq, the Russian Federation, South Africa, Saudi Arabia and the United States of America, curtailed their meat imports, underpinned by increases in domestic production, concerns over animal diseases, issues related to meat certificate requirements or a combination thereof. Much of the increased shipments in 2019 originated in the European Union, Brazil, Argentina, Australia, Mexico, Ukraine and Thailand. Despite an increase in meat output, trade disputes dampened export expansion from the United States of America – world’s second large meat producer.

April 2020/ FAO.

http://www.fao.org/