AHDB has just published a report that explores the effects of Brexit in the different agricultural sectors in the United Kingdom. The UK food and drink industry is a global force representing the UK’s fourth largest exporting sector, with exports of agricultural commodities alone valued at £6.25 billion a year. In relation to the pig sector there are different opportunities but also threats.

Opportunities

The UK may decide to keep import tariffs on pork at current EU levels and apply these to EU imports, unless a trade deal is struck. It could also decide to apply quotas to allow some imports. These actions could significantly limit the volume of EU pork entering the UK market. In the shorter term, this action would significantly tighten supplies on th e domestic market, while domestic production responded to the change in trade flow. With the tightening of supplies, it would be expected that pig price could rise sharply. However, it is hard to predict how this action would affect the UK market in the longer term.

Due to the issue of carcase balance, there would be a large excess of the less popular cuts required if domestic production were to satiate the demand for the more popular parts. This excess product would need to find a market – either at home or abroad. Consumer demand for pig meat could also be affected if customers did not respond favourably to price rises. Depending on the extent of similar issues for other meats, demand may be difficult to stimulate if, and when, supply levels recovered. Carcase balance, as well as overall demand, may be addressed by increasing trade with non-EU countries, such as China. This may depend on updating existing bilateral trade agreements to reflect the UK’s departure from the EU. The UK will be able to prioritise negotiation of FTAs which could benefit pork exporters and might be able to react quicker to any changes in policy or demand set by importing countries. The benefits would arise particularly from delivering better values for exports of lower-value cuts and offal. This could improve returns to the UK industry, as these products have little or no value on the domestic market. As well as China, there may be opportunities in emerging markets elsewhere in Asia and Africa, if the right trade deals can be negotiated. Complex FTA-type deals may not be required, if regulatory and trading arrangements can be agreed.

Threats

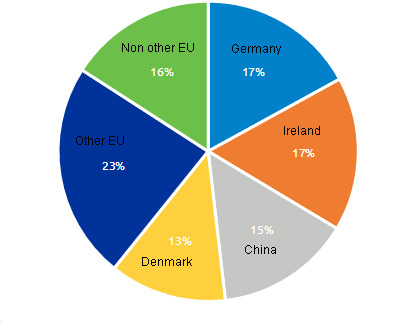

If the UK was to leave the EU before a trade deal was agreed, this would leave it vulnerable to tariffs being applied on its exported pig meat to other EU countries. Given that the EU accounts for 70 per cent of all pork exports, this could have a sizeable impact on the UK’s export market, with a knock-on effect on prices. One particular issue could be exports of sow meat. Germany is the main destination for cull sows, which have little value on the domestic market. Therefore, if these exports were subject to tariffs, it could have significant implications for this market, with sows potentially having little or no value. While this only forms a r elatively small part of producers’ incomes, it would certainly have an effect on profitability.

UK pork exports, 2015

Source: HMRC

As with other meats, there is a risk that access to some markets for pig meat or offal depends on the UK following EU rules and regulations. If trade deals are not renegotiated, this trade could be closed off, at least temporarily. Should the UK decide not to impose tariffs on imports, or negotiate quotas with global exporters, this may leave the UK market vulnerable to cheaper pork, for example from the US, Canada or Brazil, which operate at a much lower cost of production. This could cause a large over-supply in the domestic market and it would take some time for production levels to respond accordingly. While much of this additional supply may displace imports from the EU, the UK pig price would be negatively affected. This could lead to a substantial reduction of the size of the UK breeding herd. Consumer demand may increase should the price fall but recent history has shown that this may not always be the case and there are a myriad of other factors affecting the purchase decision.

Pork sector at a glance:

-

The EU currently supplies around 60 per cent of domestic pork demand.

-

Exports are important to add value to cuts unpopular with UK consumers.

-

Tariff or quota limits on the volume of pork traded between EU and UK could mean sharp price movements, affecting demand.

-

EU import tariffs could curb sow meat exports to the UK’s main customer, Germany, seriously reducing the value of UK sows.

-

Regulatory and trading agreements with individual countries on certain products may bypass need for complex FTA negotiations.

Wednesday October 12, 2016/ AHDB/ United Kingdom.

http://www.ahdb.org.uk