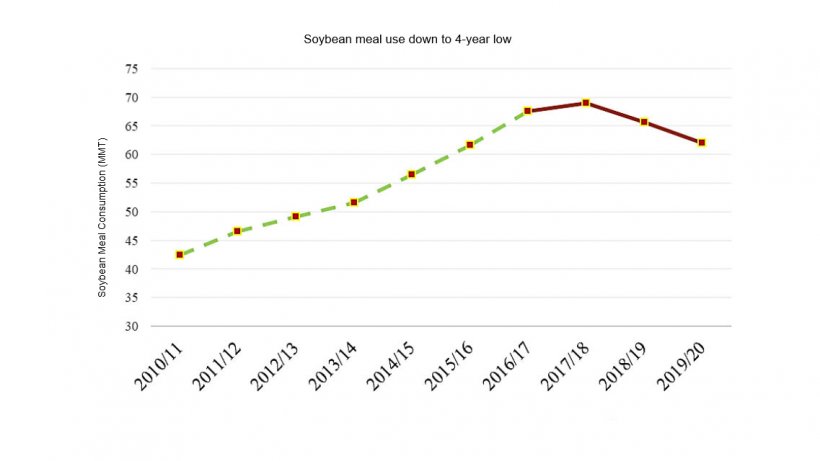

According to United States Department of Agriculture (USDA), China's soybean meal (SBM) consumption for 2019/20 and 2018/19 are unchanged from August’s report, but down from their preceding year as domestic swine inventories continue to shrink due to African Swine Fever (ASF).

Soybean imports in 2019/20 are set to be the lowest in five years. A reduction in 2019/20 and 2018/19 soybean oil consumption will be substituted with larger imports of palm and sunflower seed oils.The market for vegetable oils continues to diversify and is expected to witness further growth into 2019/20. Encouraged by subsidies favoring soybean production, farmers have increased planted area and the 2019/20 forecast remains at 17.1 million tons. Expanded soybean area has prompted projected production above the previous year.

While the number of hogs available for slaughter declined considerably since 2018, live hog prices and producer profits have skyrocketed to around 1,000 yuan (or $143)/head in late August, compared to less than 300 yuan just three months before.This reflects an increasingly tight supply of hogs for the rest of 2019 and beyond. With higher expected profits, farmers are raising larger hogs with average-slaughtering-weight up ten to fifteen percent. The rapid increase in swine profits is expected to encourage higher SBM inclusion for faster weight gain.

Meanwhile, pork’s supply shortfall and high pork prices are expected to stimulate production of other animal products including poultry, aquaculture, and ruminants. Profits for broilers and layers increased rapidly since July. These developments are expected to support demand for SBM, slightly moderating the significant drop in overall feed demand.

Monday September 4, 2019/ GAIN-USDA/ United States.

https://gain.fas.usda.gov