China’s marketing year 2023/24 total feed and residual use is forecast to change little from 2022/23, on anticipated stable hog and poultry feed demand. However, the proportion of corn mixed into rations is forecast to continue to rise.

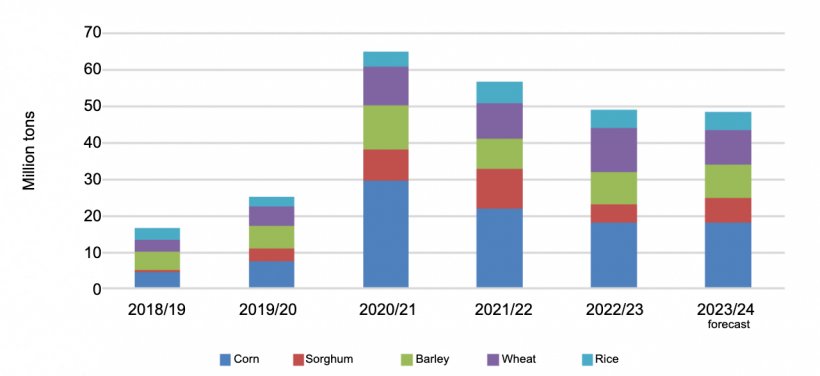

According to the latest China Feed Industry Association (CFIA) report, China’s nationwide industrial feed production totaled 302.2 MMT in calendar year 2022, up 3% year-on-year. Pig and poultry feed production accounted for 45% and 40% of total feed production, respectively, compared with 45% and 41% a year prior. Feed mills used 30% more corn in their feed rations in 2022 than in 2021. Use of wheat and barley were greatly reduced while use of sorghum, wheat bran, rice bran, and domestically produced DDGs increased significantly in 2022.

Hog production in 2023 is forecast to decline 2% to 700 million head due to a lower, on average, sow inventory in 2022 compared to 2021. With feed prices at high levels and persistently low pork prices, hog farms are unlikely to expand capacity in 2024. Beef and poultry production in 2023 is expected to be unchanged from 2022.

This year, corn planted area is expected to lose ground to soy with government policies and subsidies emphasizing more soy production. Corn imports in marketing year 2023/24 are forecast stable at 18 MMT while sorghum imports should return to higher levels with greater international supplies. Rice consumption and imports are forecast down as less broken rice is imported and used as a feed alternative.

April 6, 2023/ USDA/ United States.

https://apps.fas.usda.gov/