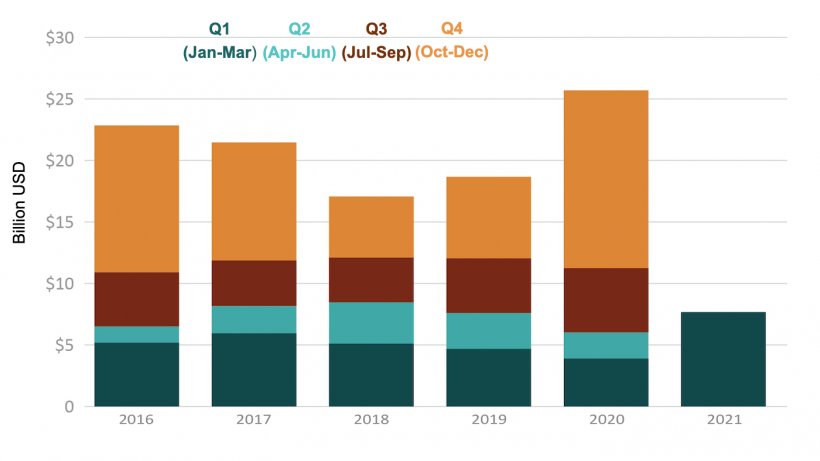

In the first quarter of 2021, U.S. soybean exports reached the second-highest value ever at $7.7 billion, nearly double from the decade low levels from the same period last year. This growth was driven by record first quarter export volumes coupled with high prices, which have been climbing steadily during the past year. Export volumes are up substantially due to the rebound of trade with China owing to the removal of retaliatory tariffs, the rebuilding of the swine herd from African swine fever (ASF), and a delayed South American harvest extending the U.S. selling window. Export values were further supported by U.S. soybean prices increasing to 7-year highs on strong China purchases, high corn prices, and tight supplies in the United States and South America.

The major growth driver in the second half of 2020 and the first quarter of 2021 for U.S. soybeans has been the reemergence of China imports. Expanding swine inventory in China increased feed demand. Additionally, implementing the Phase One agreement between the United States and China in February 2020 reduced some trade barriers and allowed U.S. farmers greater access to the growing Chinese market. However, the United States did not see exports to China spike until the second half of 2020, after Chinese purchases exhausted the Brazil soybean supply. With virtually no competition from Brazil and China importing soybeans at a record pace, the United States exported record soybean volumes and values in the second half of 2020.

In the first quarter of 2021, both the United States and Brazil, whose exports make up about 85 percent of global soybean movement, have seen an increase of more than 50 percent in the average soybean export price since the first quarter of 2020.

Part of the steady price growth has been China’s faster-than-expected recovery from ASF and subsequent growth in soybean imports. China bought the majority of the 2019/20 Brazilian soybean crop, forcing ending stocks (January 31, 2021 basis) below 2 million tons for the first time in nearly 20 years. Tight supplies have driven global prices upward and put immense pressure on the upcoming 2020/21 U.S. harvest. U.S. corn price spikes since August of 2020 have also fueled growth in soybean prices.

June 29, 2021/ USDA/ United States.

https://www.fas.usda.gov/