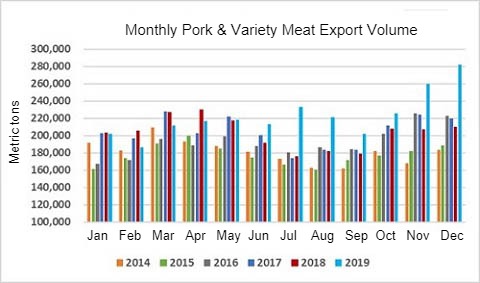

United States pork exports soared to 282,145 metric tons (mt) in December, up 34% year-over-year and surpassing the previous high (set in November 2019) by 9%. Export value was $760 million, up a remarkable 44% from a year ago and breaking the previous record (also from November 2019) by 7%. These results pushed 2019 exports 10% above the previous year in volume (2.67 million mt) and 9% higher in value ($6.95 billion), breaking previous records for both volume (2.45 million mt in 2017) and value ($6.65 billion in 2014).

For 2019, per-head value averaged $53.51, up 4% year-over-year. The percentage of pork production exported also set new records in December, as exports accounted for 32.1% of total pork production and 29.3% for muscle cuts only, up substantially from a year ago (26.1% and 23.6%, respectively). In 2019, exports accounted for 26.9% of total pork production, up from 25.7% and the highest since 2012. For muscle cuts only, the ratio was 23.6%, up from 22.5% in 2018.

For 2019, pork exports to China/Hong Kong were up 89% to 665,665 mt, valued at $1.45 billion (up 71%). China/Hong Kong’s pork imports from all suppliers in 2019 reached a record 3.45 million mt, up 40% year-over-year, and accelerated into December after China’s hog prices peaked in November.

Saddled by Mexico’s retaliatory duties for the first five months of the year, 2019 exports to Mexico were down 9% from a year ago in volume at 708,133 mt, but recovered to finish just 2% lower in value at $1.28 billion.

Full-year exports to Japan were down 6% from a year ago in both volume (369,891 mt) and value ($1.52 billion). Much of this decline was ground seasoned pork, which fell by $86 million due to a wide tariff rate disadvantage compared to European and Canadian product. Beginning Jan. 1, Japan’s tariff rates on U.S. pork and pork products were lowered to match those imposed on major competitors, with the rate for U.S. ground seasoned pork falling from 20 to 13.3%.

Other 2019 highlights for U.S. pork exports include:

- Led by substantial growth in Chile and Peru and an increase in shipments to mainstay market Colombia, exports to South America set new records in both volume (152,125 mt, up 12% year-over-year) and value ($382.3 million, up 16%).

- Strong growth in Panama, Guatemala, Honduras and Costa Rica drove pork exports to Central America to new record highs in volume (98,182 mt, up 14% from a year ago) and value ($239.5 million, up 19%).

- In Oceania, a key destination for U.S. hams and other muscle cuts used for further processing, strong demand in both Australia and New Zealand pushed exports 31% above the previous year in volume (116,113 mt) and 34% higher in value ($339.2 million), setting new records.

- Exports to Canada increased 4% from a year ago in volume (214,703 mt, the largest since 2013) and were 5% higher in value ($801.7 million, the highest since 2014).

- Exports to South Korea slowed from the 2018 records, with volume down 14% to 207,650 mt and value falling 12% to $593 million. But U.S. share of Korea’s imports increased modestly to 36%, as overall import volume also declined from 2018.

February 6, 2020/ USMEF/ USA

https://www.usmef.org/