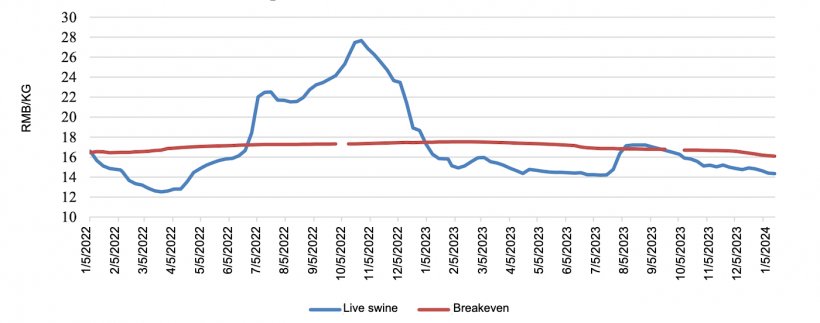

Swine production: In 2024, China is expected to produce 695 million head with a year-on-year decline of 3% due to a lower sow inventory in 2023 compared to 2022. Herd liquidation as a result of low swine and pork prices and lingering animal diseases in 2023 are the two major reasons for the lower sow inventory.

Live swine imports in 2024 are forecasted to be 7,000 head based on higher-than-expected imports in 2023 despite difficult financial conditions for swine producers. Imports should still decline in 2024 from 2023 as financial difficulties and low prices continue to weigh on producers. The main suppliers of live swine to China are the United States, Denmark, and France.

Live swine exports in 2024 are expected to be 1.14 million head, with a marginal growth in exports to Hong Kong. Hong Kong and Macao will remain the top destinations for China’s live swine exports.

Pork production is forecast to decline 3% in 2024 from fewer slaughters and lower inventory and slaughter weight of fattened swine.

Pork consumption in 2024 is expected to reach 57.8 MMT, with a decline of 3% year-on-year,

mainly due to sluggish economic activity. Although pork is a staple meat in China, demand for pork products has decreased as the economy continues facing challenges in 2024.

Pork imports in 2024 are expected to grow marginally at 1.95 MMT as imports offset the decline in domestic pork production. High year-end inventories carried over into 2024 will suppress imports until traders diminish their supplies. China’s major pork suppliers are Spain, Brazil, Denmark, the Netherlands, Canada, and the United States.

Pork exports are expected to see a marginal increase in 2024 at 100 thousand MT. Hong Kong and Japan are the two major export destinations for pork products.

March 8, 2024/ USDA/ United States.

https://apps.fas.usda.gov